BLOGS

2022 2nd Quarter Reminders

IRS Published Revenue Procedure 2012-32

As your Reporting Agent for payroll tax filings, the IRS Published Revenue Procedure 2012-32 requires us to send you the following information on a quarterly basis.

"Please be aware that you are responsible for the timely filing of the employment tax returns and the timely payment of employment taxes for your employees, even if you have authorized a third party to file the returns and make the payments. Therefore, the Internal Revenue Service recommends that you enroll in the US Treasury Department's Electronic Federal Tax Payments System (EFTPS)."

Recommended by the IRS and encouraged by myPay Solutions

To monitor your account and ensure that timely payments are being made for you, the IRS recommends that you enroll in the US Treasury Department's Electronic Federal Tax Payments System (EFTPS). To enroll online, visit EFTPS.gov or to get an enrollment form, call 800.555.4477.

Although there are no actions necessary, we encourage you to enroll in EFTPS if you'd like to monitor the payroll tax payments we make on your behalf.

Note: State tax authorities generally offer similar means to verify tax payments. For details, contact the appropriate state offices directly.

Submit all 2nd quarter information to us by Monday, June 27, 2022

To avoid tax penalties and re-processing fees, please submit all 1st quarter data to your payroll specialist by Monday, June 27, 2022.

Provide your state unemployment insurance (SUI) tax rate

Each calendar year, your business is assigned a unique state specific SUI tax rate based on your employment history. You should receive notification of your assigned SUI tax rate by mail from the agency, or you may need to obtain the rate online. This rate is essential to accurately calculate your tax returns; incorrect rates may result in potential penalties for underpayment. myPay Solutions is not always provided updated SUI rate information directly from the state, therefore we rely on you to forward information you have received to close the gap on using outdated rates.

If you have not already done so, please send your 2022 SUI tax rate to us as soon as possible and be on the lookout for your 2022 SUI tax rate notice(s). Rates can be provided to us via the secure File Exchange option on your portal or faxed directly to our tax team at 888.403.5750.

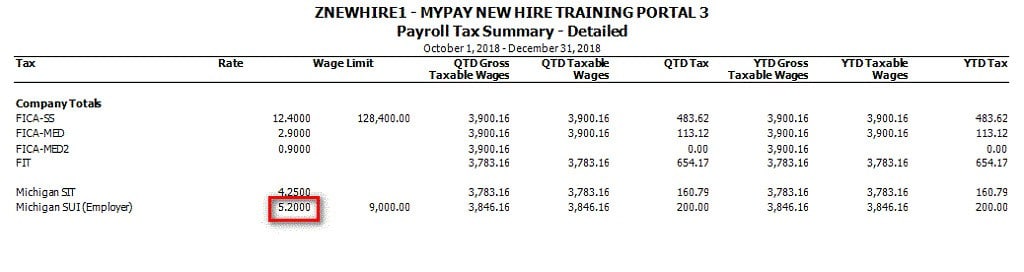

To confirm that we have the correct SUI tax rate(s) on file for your business, please review the last page of the Payroll Tax Summary – Detailed report in your most recent set of payroll reports:

Provide your state withholding filing frequency

If you received a notice that your state withholding filing frequency has been changed, please provide a copy of the notice to us. Notices can be provided to us via the secure File Exchange option on your portal or faxed directly to our tax team at 888.403.5750.

Make sure your company and employee data is up-to-date.

Please notify your payroll specialist of any changes to your company address, contact information or bank account information.

Please verify all employee personal, payroll and W-4 data for accuracy.

The W-4 was redesigned in 2020, so please ensure your employees are reading the instructions carefully before making any updates to their information. You should have a Federal Form W-4, Employee's Withholding Allowance Certificate along with any applicable state and local withholding tax forms on file for each employee. FAQs on the new form can be found here.

A Form W-4 remains in effect until the employee gives you a new one. You are not required to obtain new W-4s for your employees each year unless they claim exemption from income tax withholding. Exempt W-4s expire on February 15 of the following year. If employees claim exemption from tax withholding, they must give you a new Form W-4 each year. If the employee does not provide a new W-4, treat the employee as a single filer with no other adjustments or use the last W-4 on file with filing status and allowances

2022 Holiday Schedule

The list below shows dates that represent a national bank holiday and/or dates myPay Solutions will be closed. National bank holidays are considered non-processing days and have been accounted for in all Payroll Data Submission Deadline Schedules.

Please review your company's personalized payroll schedule carefully to ensure that you're able to meet submission deadlines. Please click here for additional details regarding processing guidelines on holiday weeks. Your personalized Payroll Schedule can be generated within the myPay Solutions Direct payroll application by accessing Actions>Print Reports>Payroll Schedule. Please click here for full instructions.

Monday, May 30, 2022 (Memorial Day)

National bank holiday—myPay Solutions will be closed

Monday, June 20, 2022 (Juneteenth)

National bank holiday—myPay Solutions will be closed

Monday, July 4, 2022 (Independence Day)

National bank holiday—myPay Solutions will be closed

Monday, September 5, 2022 (Labor Day)

National bank holiday—myPay Solutions will be closed

Monday, October 10, 2022 (Columbus Day)

National bank holiday—myPay Solutions will be open

Monday, October 24, 2022 (Thomson Reuters Mental Health & Wellness Day)

Company holiday—myPay Solutions will be closed

Friday, November 11, 2022 (Veterans’ Day)

National bank holiday—myPay Solutions will be open

Thursday, November 24, 2022 (Thanksgiving Day)

National bank holiday—myPay Solutions will be closed

Friday, November 25, 2022 (Day After Thanksgiving)

Company Holiday - myPay Solutions will be closed

Monday, December 26, 2022 (Christmas Day Observed)

National bank holiday—myPay Solutions will be closed

Questions?

For more info, please contact your Payroll Specialist.