If you are an employee whose company uses myPay Solutions for payroll services, and you are in need of support, please contact your on-site Payroll Administrator for assistance. We are unable to reply to requests for assistance through this website.

Getting started

Get started today by contacting myPay Solutions. Our team members will walk you through the process of what to expect, and then personally reach out to your accountant to get the correct forms and documents filled out to begin your payroll.

Data Security

As a trusted global technology company, our digital security is among the best, and regularly undergoes third-party audits to ensure that your data is protected from digital threats and attacks.

System requirements

Internet Explorer® version 8.0 or higher or Mozilla Firefox® version 3.0 or higher is required for myPay Solutions customer self-service activity. For security, we recommend a minimum of 128-bit encryption.

Mobile app

The myPay Solutions mobile app is free and enables your employees to perform a variety of the most common payroll activities in real time, right from their smartphones or other mobile devices.

Benefit from a full site of payroll reports

-

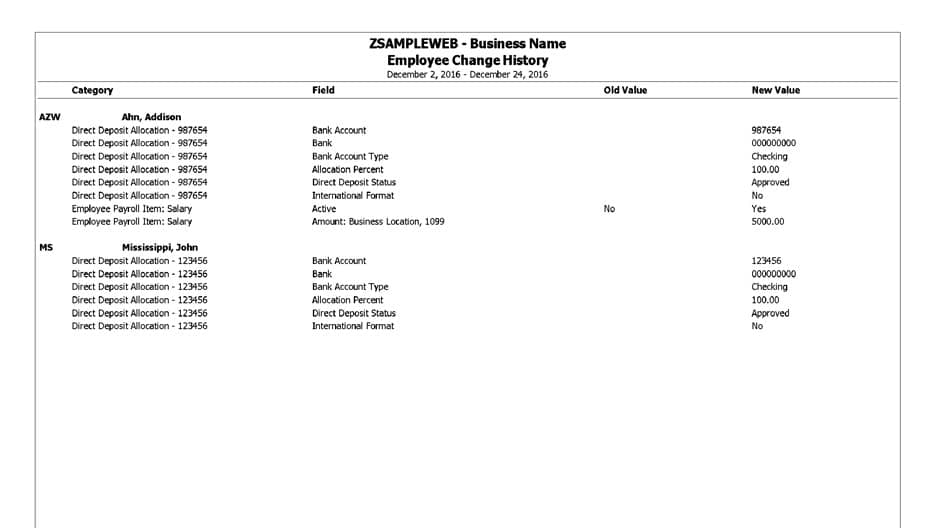

Employee change history

This report will reflect any changes that are made between payroll runs so you can audit changes made, along with who made the changes.

-

Payroll tax summary

This report shows you quarter-to-date (QTD) and year-to-date (YTD) gross wages and the tax reflected on those checks, for each employee.

-

Payroll journal

This report is a snapshot of each employee’s paycheck for the current payroll

-

Employee earnings

This report shows what each employee has earned on a current, month-to-date (MTD), quarter-to-date (QTD) or year-to-date (YTD) basis.

-

Cash requirements & deposits

This report shows the total cash needed for your payroll.

-

Depository totals

This report is a summary of tax payments to be made for the current payroll.

-

Payroll memorandum

This report is a summary of your period and check date, and a reference for any missing tax information that our tax department needs.

-

Payroll checklist

This report shows the summary of all payroll and vendor checks issued — paper and voucher — for the current payroll.

Payroll forms and documents for myPay Solutions users

Find the forms you need to take care of payroll setup and maintenance.

| Federal Forms | Employee Forms |

|---|---|

| Reporting Agent Authorization | Employee’s Withholding Allowance Certificate |

| Application for Employer Identification Number | Employment Eligibility Verification |

| Hiring Incentives to Restore Employment (HIRE) Act Employee Affidavit | |

| Note: Paper applications can take several days to process. You can receive your EFIN instantly by applying online. | For questions, including those concerning the box 12 code letter instructions refer to the IRS Instructions for forms W-2 and W-2 |

Power of attorney and state forms

Let us know which state(s) you need to cover. We’ll provide the specific forms you need, with some of the relevant information already filled in.

Disclosures and Licences

If your issue is unresolved by Creative Solutions Software Corp dba myPay Solutions 844-332-5157 please submit formal complaints with the State of Alaska, Division of Banking & Securities. Please download the form here: form

Submit formal complaint form with supporting documents:

Division of Banking & Securities PO Box 110807 Juneau, AK 99811-0807 If you are an Alaska resident with questions regarding formal complaints, please email us at dbs.licensing@alaska.gov or call Nine Zero Seven Four Six Five Two Five Two One

The Commissioner of Financial Regulation for the State of Maryland will accept all questions or complaints from Maryland residents regarding Creative Solutions Software Corp dba myPay Solutions license number 12- 1445015 and NMLS ID 1445015 by contacting the Commissioner’s office at 500 North Calvert Street, Suite 402, Baltimore, Maryland 21202, or 888-784-0136.

Creative Solutions Software Corp (dba myPay Solutions) is Licensed as a Money Transmitter by the New York State Department of Financial Services.

Money transmission services are provided by Creative Solutions Software Corp dba myPay Solutions. If after contacting myPay Solutions customer support at 844-332-5157, you feel your complaint is unresolved, please direct your concern to the Texas Department of Banking at:

Texas Department of Banking

2601 North Lamar Boulevard

Austin, TX 78705

877-276-5554 (toll free)

Payroll-related services

These additional services, available through our preferred partnerships, complement your myPay Solutions online payroll service.